Banks and other financial institutions can no longer rely on out-dated analog methods. Today’s active customers expect digital interactions, personalized services, and streamlined processes—there are simply no exceptions.

Digital transformation in banking has propelled the finance industry into an era of agile, customer-focused solutions. Secure mobile apps, automated workflows, and data-driven intelligence are the norm now, shaping how banks and fintech serve their global markets.

Why Digital Transformation in Banking Matters

What is digital transformation in the financial services sector? At its core, digital transformation is about leveraging modern technology—cloud computing, AI, mobile interfaces—to enhance every step of the customer journey.

The shocking truth is, according to a McKinsey report, the average age of bank IT applications is among the highest across industries. The average insurance app is at least 18 years old, making it difficult for organizations to provide a platform necessary for our digital future.

- Changing Customer Expectations: According to the latest Statista report, customers demand seamless service across all channels, from mobile applications to ATMs. This has blurred the lines between physical and digital banking, creating fully digital experiences. Europe leads in digital banking adoption, particularly the Nordics, with Denmark topping the charts at a nearly 98% online banking penetration.

- Efficiency and Cost Reduction: Deloitte reports that over half of banking executives aim to improve productivity with generative AI, with 38% of them expecting cost reductions.

- Regulatory Compliance and Security: Rapidly evolving regulations (like PSD2 in the EU or KYC/AML checks worldwide) require flexible software solutions. Digital tools can automate compliance monitoring, reducing human error and hefty fines.

- Data-Driven Decision Making: Real-time analytics help banks spot fraud patterns, tailor credit offers, and forecast market shifts. That data fuels better risk assessments and personalized banking products.

- Better Risk Management: Real-time data analytics identify suspicious activities quicker. Machine learning models continuously refine credit scoring and fraud detection, boosting overall financial stability.

- New Revenue Streams: Digital channels open up cross-selling opportunities, such as offering insurance products alongside banking, or bundling subscription services with a savings account. Through these efforts, cross-industry partnerships become more feasible.

Key Trends Driving Digital Banking Transformation

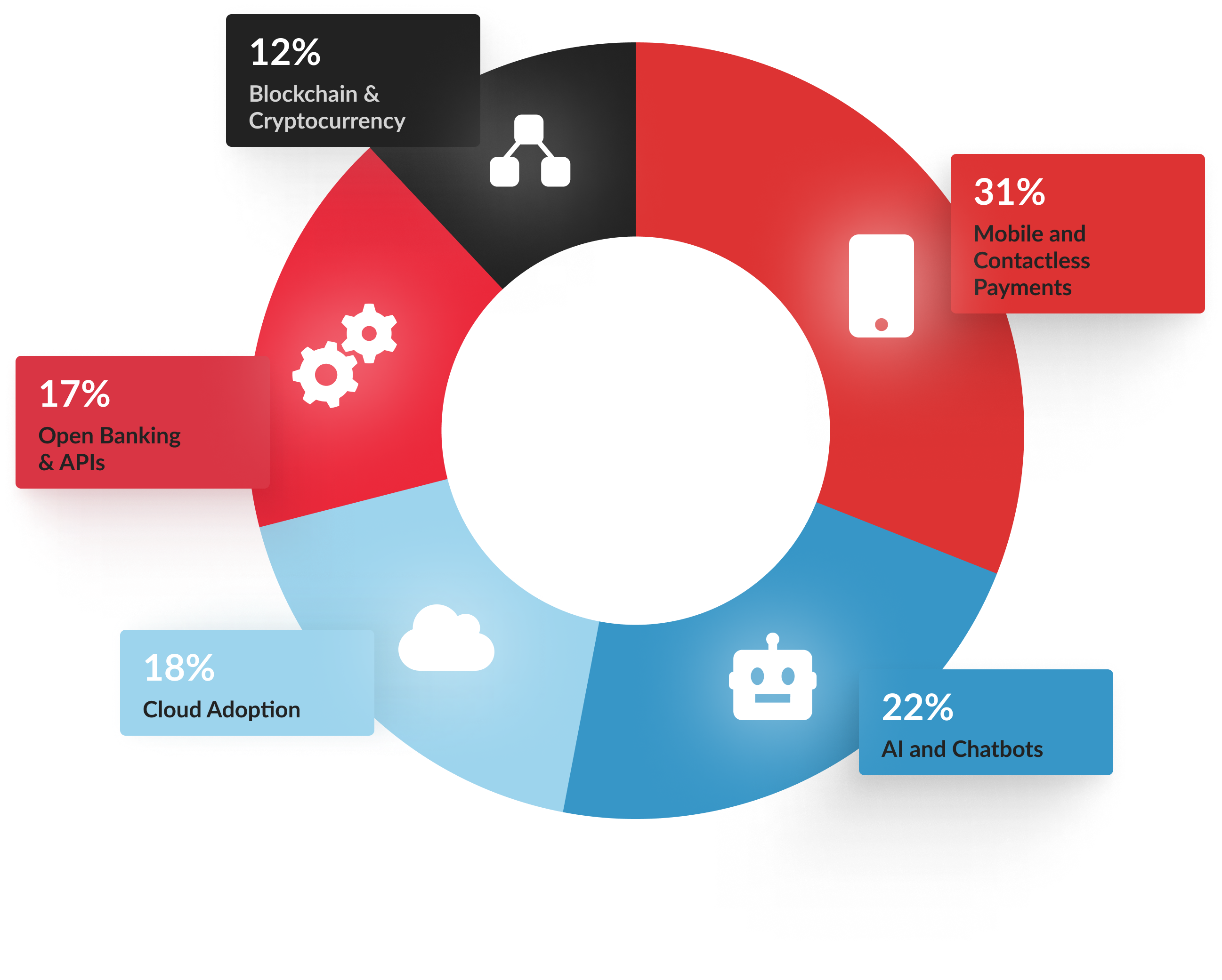

Banks worldwide are racing to update their tech stacks and user experiences. Below are the major trends shaping digital transformation in banking, as well as the strategies guiding forward-thinking institutions.

- Mobile and Contactless Payments: Smartphones can now handle everything, from online transfers to NFC-based point-of-sale payments. According to Yahoo Finance, contactless payments are forecast to exceed $15.7 trillion in transaction value by 2027, a testament to the impact of digital transformation in BFSI.

- Open Banking & APIs: Open banking regulations (e.g., PSD2 in Europe) require banks to share customer data with third parties (with user consent). This fosters an ecosystem where fintech startups and legacy banks collaborate via APIs, delivering innovative services like aggregator dashboards or micro-loans.

- AI and Chatbots: Artificial intelligence isn’t just about robotic investment advice. Chatbots handle basic support queries, freeing up call centers for complex tasks. Meanwhile, AI-driven underwriting can streamline loan approvals, cutting decision times from days to minutes.

- Cloud Adoption: Banks historically kept everything on-prem, but modern solutions deploy infrastructure on secure clouds. This shift lowers hardware costs, accelerates innovation, and supports new banking technology, such as real-time fraud detection.

- Blockchain & Cryptocurrency: Blockchain-based tools offer transparent ledgers, potentially reducing transaction fees and speeding settlement times. Some banks now support digital assets, bridging traditional finance with decentralized finance (DeFi) services.

Challenges of Digital Transformation in Banking

Despite the clear benefits, transitioning to a digital banking transformation isn’t all smooth sailing. Below are the common hurdles one can face:

- Legacy Infrastructure

Many banks rely on COBOL-based mainframes from decades ago. Integrating new tech with old systems can be complex. At Redwerk, we can help you modernize your legacy software and connect it to modern apps. - Security & Compliance

Cyberthreats evolve daily. Ensuring compliance with PCI DSS, GDPR, and local banking laws demands robust solutions. Security lapses can mean huge fines and reputational damage. - Cultural Resistance

Employees who are unaccustomed to agile or DevOps models can slow adoption. Leadership buy-in and training are essential for a smooth transition. - Data Privacy Concerns

Handling sensitive financial data requires encryption and transparent user consent. Overlooked privacy protocols can lead to litigation risks. - High Initial Costs

Migrating to the cloud, adopting AI, and redesigning customer portals costs significant time and money. However, the long-term ROI often justifies the investment.

At Redwerk, we’re committed to building software that meets the highest industry standards. For example, we developed an ADA-compliant solution for US public service agencies and implemented a platform upgrade for the European Parliament.

How to Approach Digital Transformation in Financial Services

Embarking on a digital transformation in banking requires focus, strategy, and the right partnerships. Here’s how we suggest to start:

- Audit Current Systems. Identify bottlenecks such as slow loan approvals, manual compliance checks, or outdated UI elements. Evaluate potential quick wins, like automating repetitive tasks. Here at Redwerk, we can perform a thorough SDLC audit to pinpoint inefficiencies in your software development pipeline. We’ll ensure that your team can keep growing, while releasing on time and within budget.

- Define Clear Goals: Are you aiming to expand into mobile-only banking, opening APIs for third-party fintech, or revamping your entire core banking platform? Align technology priorities with business objectives.

- Adopt an Agile Mindset: Incremental rollouts help gauge user feedback faster. Small pilots or MVPs can confirm feasibility before large-scale deployment.

- Leverage Partnerships: Collaborate with payment processors, cloud service providers, or fintech startups. Partnerships accelerate innovation and minimize development overhead.

- Measure KPIs and Refine: Tracking metrics such as user adoption, average transaction time, or service downtime, helps teams spot issues early and refine the transformation strategy.

Redwerk’s Expertise in Digital Banking Transformation

At Redwerk, we specialize in custom software engineering and legacy software modernization for financial institutions. Whether you need a secure digital wallet, a robust lending platform, or advanced analytics integrations, our cross-functional teams can help with:

- Custom Banking Solutions: From branchless banking apps to specialized compliance systems.

- Scalable Fintech Apps: Optimized for high concurrent usage and real-time data processing.

- Legacy Modernization: Retool outdated core systems for better performance, security, and maintainability.

- User-Centric Interfaces: Our UI/UX design approach ensures frictionless experiences and higher customer satisfaction.

We’ve also proven our ability to streamline complex workflows outside of BFSI. For example, we helped Mass Movement develop a custom inventory management system and a resource planner, resulting in a significant reduction of operating costs and subsequent acquisition by J.B. Hunt, North America’s transportation giant. Although it’s a different sector, the same approach of optimizing processes, integrating new tech, and ensuring scalability applies directly to digital transformation in banking and financial services.

The Future of Digital Transformation in Banking

What is digital transformation in the banking industry likely to look like next? Expect hyper-personalized services (e.g., AI-based financial coaching), broader biometrics, and real-time cross-border payments. Open banking will expand further, letting customers pick from multiple providers in one integrated platform. Meanwhile, advanced analytics and machine learning will keep refining risk assessments, pointing to a more collaborative, data-driven BFSI landscape.

Real-Life Examples

- N26 and Revolut (Europe): Fully app-based platforms that provide real-time currency exchange, budgeting tools, and streamlined onboarding—illustrating how a purely digital approach can attract millions of users.

- Chime and Varo (U.S.): These entities are neobanks with no physical branches. They focus on frictionless sign-ups, zero hidden fees, and instant notifications. Their success demonstrates that customers, especially younger demographics, embrace digital-first solutions. Chime’s positive user ratings support this assessment, with 57% of surveyed users holding a favorable view of the company.

- BBVA (Spain): Known for investing heavily in AI and mobile tech to deliver innovative products like real-time loan decisions and advanced cybersecurity measures—key aspects of a future-ready bank.

Speaking plainly, the path forward involves continuous investment in new technologies, partnerships with fintechs, and a user-centric mindset. Institutions that fail to adapt will surely risk becoming irrelevant in this rapidly evolving financial ecosystem.

Conclusion

Digital transformation in banking and financial services is more complex than offering a mobile app or access to online statements. It requires strategic planning, modern tech adoption, and a user-first mindset. Upgrading legacy systems, automating compliance checks, and leveraging data analytics can deliver immense ROI—both in customer satisfaction and operational efficiency.

At Redwerk, we help financial institutions implement custom-built solutions that accelerate this transformation, while also ensuring robust security and compliance. Contact us today to book a free consultation. Let’s take the first step toward delivering secure, agile, and customer-focused banking solutions that help you thrive in an evolving financial landscape.

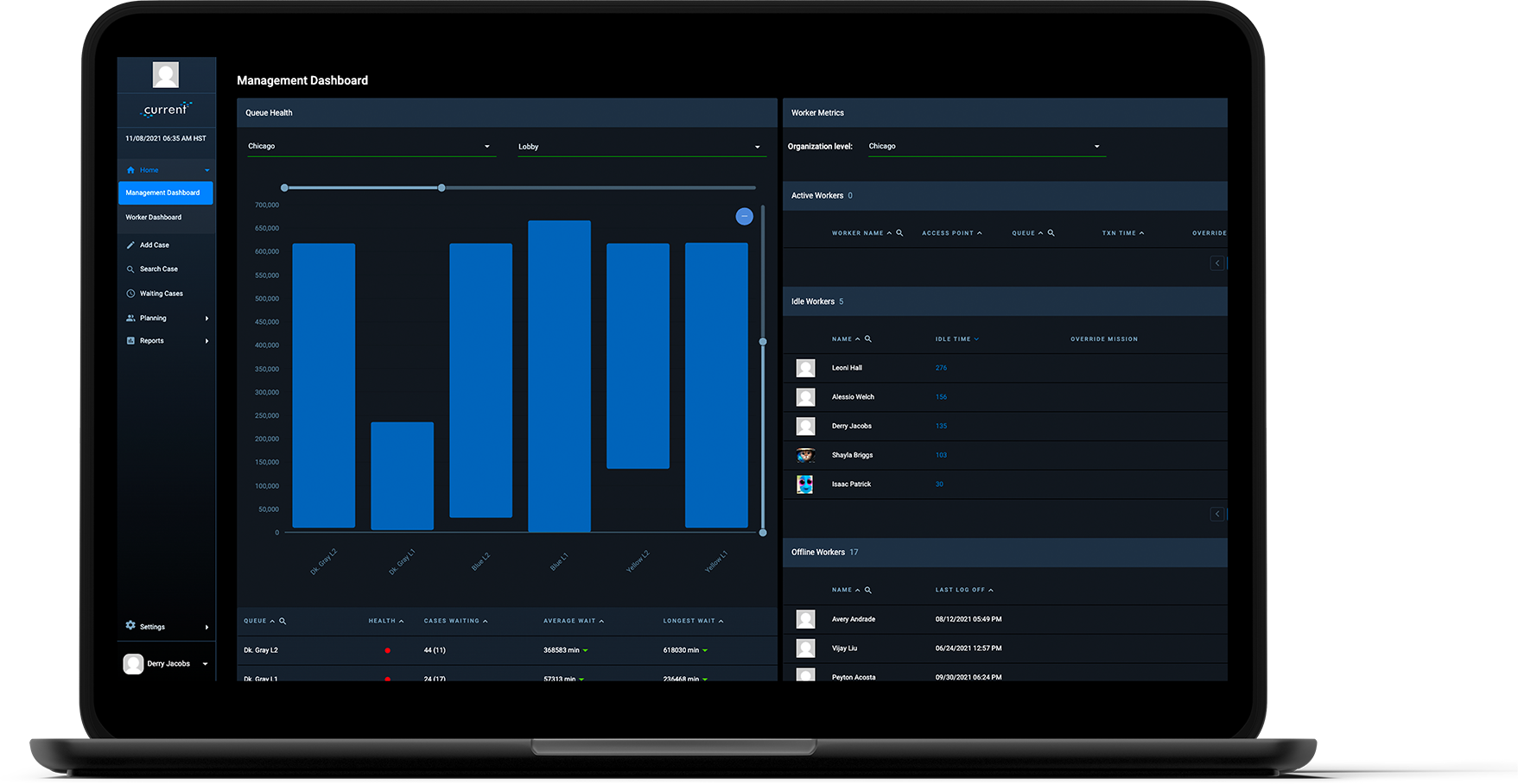

See how we built an ADA-compliant SaaS, streamlining workflows and providing visibility into the case resolution progress