You’re an entrepreneur building a fintech product that stands out in a crowded market. AI in fintech promises to be the borderless key to unlocking faster operations, smarter decision-making, and truly personalized experiences. But adding artificial intelligence in fintech projects requires more than enthusiasm—it demands a strategic approach to reap real rewards without costly missteps. Let’s walk through what you need to keep in mind, all backed by the latest market insights and practical know-how.

Why AI Is Driving Fintech’s Future

The AI in fintech market is projected to see explosive growth, reaching $52.19 billion by 2029 with a CAGR of 30.9%. Key growth drivers include the widespread adoption of chatbots and virtual assistants, growing emphasis on regulatory compliance automation, the rise of robo-advisors in wealth management, and cybersecurity enhancement with AI. Additionally, digitalization trends such as alternative credit scoring models, cross-selling and upselling recommendations, and decentralized finance (DeFi) automation will play pivotal roles.

Fintech companies are always trying to get better at catching fraud, which is why many of them are viewing artificial intelligence in finance as a solution. AI’s ability to continuously learn and improve from new data allows financial institutions to stay ahead of increasingly sophisticated threats. For example, Britain’s financial sector reported a record 3.31 million fraud cases in 2024, marking a 12% increase from the previous year, with losses totaling £1.17 billion, highlighting the urgent need for advanced fraud protection solutions.

North America leads in market size, but regions such as the Asia-Pacific, Western Europe, Eastern Europe, and the Middle East are rapidly expanding their AI fintech ecosystems, supported by regulatory frameworks and innovation.

This growth trajectory confirms that AI fintech solutions will be central to the future of finance, delivering smarter, safer, and more personalized services globally.

Key Factors for Fintech Founders Before Adding AI

Generative AI in financial services isn’t simply about plugging in new tech. It’s a complex journey filled with both great opportunities and real obstacles. Understanding the major factors—from regulatory hurdles to data quality, from technology choices to user trust—can make the difference between AI success and costly failures.

With the rapid evolution of AI in fintech and the introduction of new regulations, every founder needs a clear playbook to avoid common pitfalls and maximize their impact.

Use-Case Alignment

Target solutions that solve your unique challenges, like fraud, personalization, or compliance

Maximize ROI by applying AI to problems that matter

Data Integrity & Compliance

Establish robust governance and privacy compliance from day one

Prevent legal risks and raise AI accuracy

Flexible Tech Stack

Adopt scalable frameworks (Python ML, APIs) to evolve AI features easily

Avoid costly rewrites and keep options open

User Trust & Clarity

Make AI decisions explainable and interfaces user-friendly

Build confidence and reduce user churn

Continuous Iteration

Plan for ongoing model tuning, monitoring, and regulatory updates

Keep AI relevant and effective over time

Security & Ethics

Mitigate cyber risks and algorithmic bias with proactive strategies

Uphold reputation and satisfy regulators

Measurable Outcomes

Define KPIs like fraud loss reduction and customer satisfaction

Prove AI’s impact with hard data

AI Applications in Finance: Start with Goals

Many fintech founders jump into AI driven by trends, but the real wins come from laser-focused problem solving. Fintech AI must target your highest-impact challenges—fraud mitigation, credit risk, and compliance top the list. Trying to bolt on every new AI solution for fintech dilutes focus and drains budget. Define exactly which fintech AI use cases will move the needle for your users and bottom line. This clarity keeps your product impactful and your roadmap manageable.

Successful integration of AI in banking and finance requires a clear strategy. So, before you code, clarify your priorities:

- Fraud detection and risk management

- Real-time personalized financial recommendations

- Automated regulatory compliance

Focus on practical AI solutions for fintech that address your users’ toughest pain points. Forget shiny tech for tech’s sake—that rarely translates to value.

Data Is the Fuel for AI

AI only works if your data is solid. Behind every successful AI in fintech market solution is a foundation of high-quality data.

Before you go any further with implementing AI for financial services, ask yourself these critical questions about your data:

- Do we have it? Do you have enough historical, structured data to train a model? For credit scoring, you need years of loan performance data. For fraud detection, you need vast datasets of both fraudulent and legitimate transactions.

- Is it clean? Is your data organized, labeled, and free of errors and inconsistencies? Data cleaning and preparation often account for 80% of the work in an AI project.

- Is it accessible and secure? How will your AI system access the data it needs in real-time? Given that you’re in fintech, how do you ensure compliance with regulations such as GDPR, CCPA, and industry-specific data security standards?

Tip: Invest in data infrastructure and quality control early, or your AI in fintech market ambitions will face roadblocks.

Technology Choices Matter

Choosing the right tech stack is as important as choosing your AI goals. Drawing on our deep expertise in artificial intelligence development, we can help you select the most suitable technology for your business needs—especially when it comes to AI applications in finance.

Your tech stack must support AI’s complexity while staying nimble:

- Leverage Python ML frameworks like TensorFlow or PyTorch for backend AI development.

- Utilize modular APIs to integrate AI capabilities without requiring full app rewrites.

- AI chatbots with natural language understanding improve customer engagement.

Scalable tech enables continuous building, testing, and improvement of AI features without risking the entire product.

User Experience and Transparency Are Key

Fintech users interact with money and sensitive data on a daily basis. To earn and keep their trust, your AI must be clear, reliable, and easy to understand.

Explain How AI Impacts Decisions, Avoiding Black Box Effects

Users need insight into how AI comes to its conclusions. Explainable AI models reveal the factors behind decisions, such as loan approvals or fraud alerts, making your fintech app more transparent and compliant. This lowers distrust and supports regulatory requirements around fairness and accountability.

Keep UI Intuitive. Complexity Should Stay Behind the Scenes

Artificial intelligence in fintech is powerful, but should never complicate the user experience. Design interfaces that feel natural and straightforward. Let AI’s complexity power smarter features, while users enjoy seamless, simple journeys. Intuitive design reduces frustration and increases engagement.

Use AI-Driven Personalization Thoughtfully to Avoid Overwhelming Users

Personalization can boost satisfaction, but too much can confuse or annoy. Apply fintech AI personalization selectively—recommend products or flag risks with sensitivity to user context. Balanced personalization creates relevance without clutter.

Trust is the foundation of financial apps. Simplicity in design and clear communication about AI builds user confidence. When users understand what AI does and why, they’re more likely to adopt and stay loyal to your product.

AI in Finance Implementation: The Big Choice

So, you have a problem and you have the data. Now, how do you capitalize on fintech AI and tap into the true potential of AI in banking and finance? Generally, you have three main options.

Train

This means training a foundation model on your proprietary data.

- Pros: Perfectly tailored to your unique needs, creating a powerful competitive advantage.

- Cons: May be expensive, time-consuming, and requires a highly specialized team of data scientists and ML engineers.

- Best for: Core business functions where no off-the-shelf solution can provide the edge you need.

Buy

- Pros: Much faster to implement, lower upfront cost, and the technology is already proven.

- Cons: It’s a one-size-fits-many solution that might not fit your workflow perfectly. You are also dependent on the vendor’s roadmap and pricing.

- Best for: Standardized problems like KYC (Know Your Customer) checks or basic AML (Anti-Money Laundering) screening.

Integrate

This means leveraging powerful, pre-trained models via APIs from major players like OpenAI (ChatGPT), Google (Gemini), or Anthropic (Claude).

- Pros: Gives you access to state-of-the-art AI without the massive R&D cost. It’s flexible, scalable, and you can often get a proof of concept running quickly.

- Cons: Can become costly at high volumes, and you need to be mindful of data privacy policies (where is your customers’ data being sent and processed?).

- Best for: Features involving natural language, like creating personalized financial summaries, powering advanced chatbots, or analyzing customer feedback.

Partnering with teams that understand both the fintech domain and the nuances of AI development is crucial. This approach ensures that your AI keeps pace with market trends and regulatory shifts, thereby protecting both your users and your business.

Final Words

Incorporating AI in fintech requires clear thinking, precise execution, and relentless focus on user value. You can think that it is pursuing trends, but it’s all about mastering the details that define success in financial technology today. Nail your data strategy, pick the right AI battles, monitor outcomes closely, and prioritize transparency. When done well, AI accelerates growth, reduces risk, and sets your fintech product apart from the pack.

Ready to build a standout solution with AI for fintech? Contact us today to discuss your project.

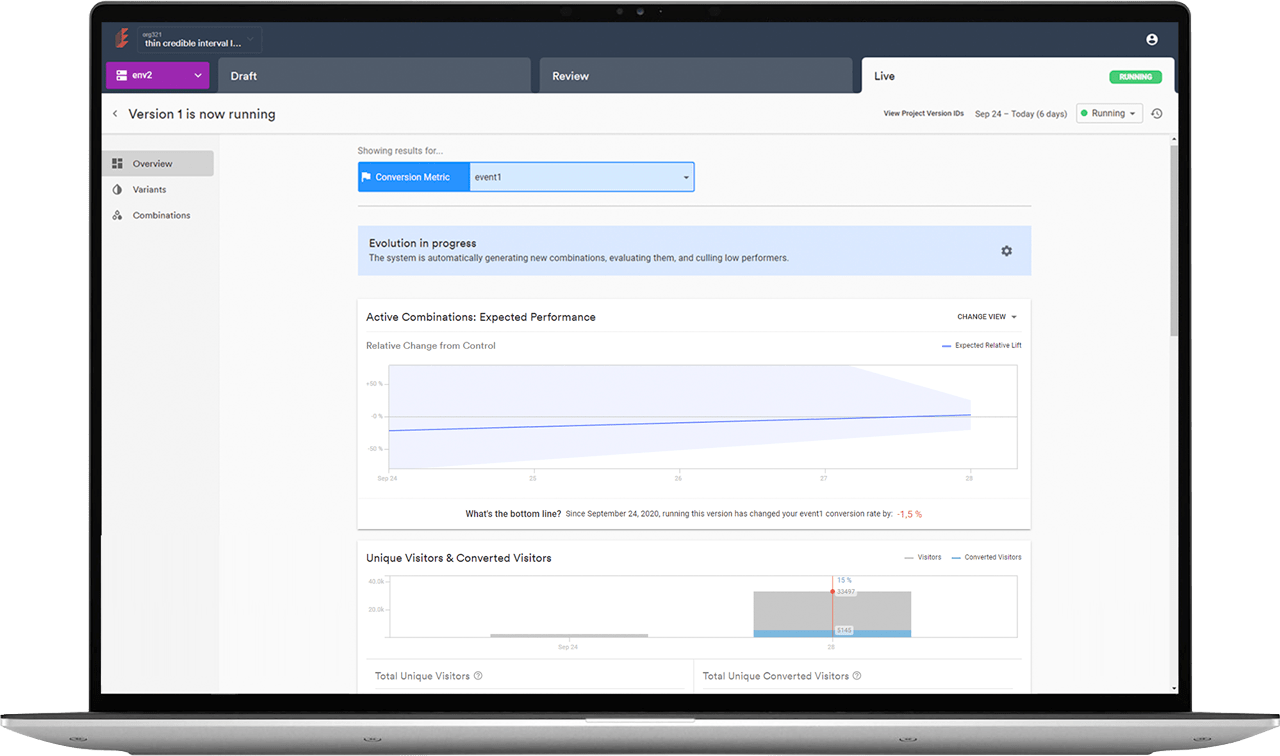

See how we helped Evolv, an AI-led UX optimization platform, rearchitect its core product and power the launch of 20+ successful releases